Revolut Fee Calculator

Estimate Revolut transfer fees and currency exchange costs. Based on verified data from official Revolut sources. Always confirm exact fees in the Revolut app before transferring.

Revolut Fee Structure (2026)

- • Revolut-to-Revolut: 100% FREE, instant, in 25+ currencies

- • SEPA (Europe): FREE for EUR transfers within EEA

- • International: Free within plan allowance, then up to 5% or $10

- • SWIFT: Flat $5/£5/€5 fee + exchange rate

Calculate Your Fees

Enter an amount to calculate fees

Important: Fees shown are estimates. Actual fees depend on your account plan, monthly allowance usage, and destination. Always verify exact fees in the Revolut app before sending.

Exchange rates: Real-time rates from OpenExchangeRates API. Revolut may apply spreads or weekend markups.

Revolut is a digital banking platform that has revolutionized how we think about money management and international transfers. Founded in 2015, Revolut offers multi-currency accounts, instant money transfers, currency exchange, and traditional banking services through a modern mobile app. With over 25 million customers worldwide, Revolut has become a popular choice for travelers, digital nomads, and businesses dealing with multiple currencies.

Understanding Revolut fees is important because their pricing model differs significantly from traditional banks and money transfer services. Revolut offers competitive exchange rates and low transfer fees, but costs can vary based on your account type (Standard, Premium, or Metal), monthly usage limits, and the specific currencies involved in your transactions.

Our Revolut fees calculator helps you understand the exact costs for international transfers, currency exchanges, and other services. Whether you're planning to send money abroad, exchange currencies for travel, or manage a multi-currency business, calculate your fees accurately before making transactions.

This calculator estimates Revolut transfer fees based on their tiered structure:

- • Transfer fee: Decreases with amount (~0.8% small transfers → 0.645% at $100k → 0.53% at $1M+)

- • Fair usage: 0.5% after limits (Standard: $1k/mo, Premium: $10k/mo, Metal: unlimited)

- • Weekend markup: 1% for in-app exchanges only (not bank transfers)

- • Plan discounts: Premium 20% off, Metal 40% off SWIFT fees

Special rates: UK/EU flat fees (£5/€5). SEPA transfers FREE. Revolut-to-Revolut: 100% FREE in 25+ currencies.

How Revolut Fees Are Calculated

For bank transfers, Revolut charges a simple tiered transfer fee based on amount:

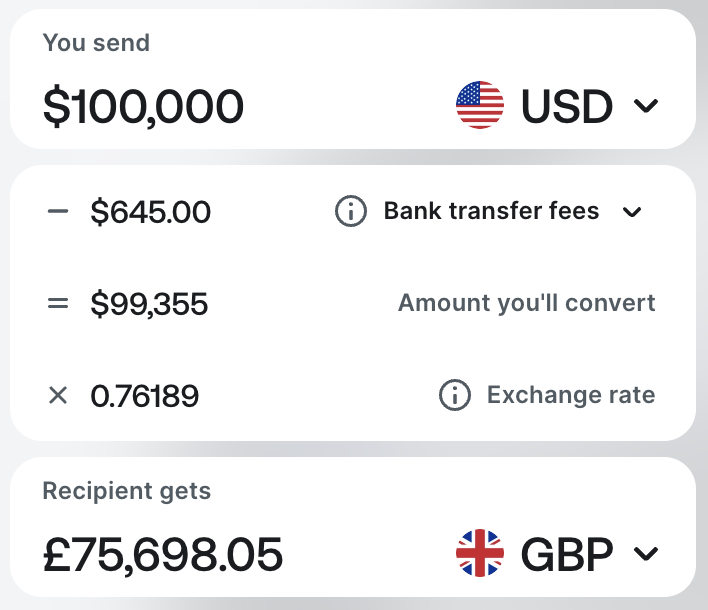

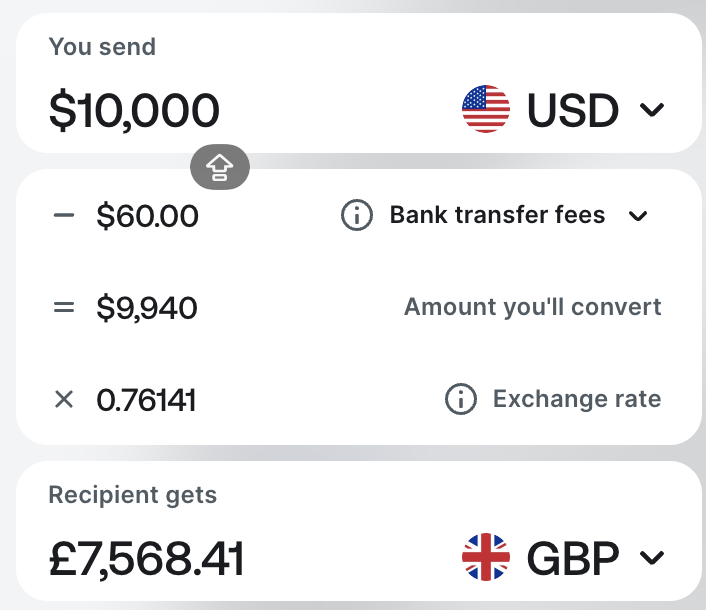

Bank Transfer Fees (Based on Real Data)

- • $10,000: $60.00 (0.60%)

- • $100,000: $645.00 (0.645%)

- • Fee percentage varies by amount (tiered structure)

Plan Discounts

- • Standard: Full fee

- • Premium: 20% off transfer fees

- • Metal: 40% off transfer fees

UK/EU customers pay flat fees (£5/€5) instead of percentage-based fees.SEPA transfers within Europe are FREE (Mon-Fri). Revolut-to-Revolut transfers are 100% FREE globally in 25+ currencies.

Revolut Account Types & Fees:

Standard (Free)

- • FREE - no monthly fee

- • $1,000/month free conversions

- • 0.5% fair usage fee after $1k

- • No SWIFT fee discount

- • +1% weekend markup

- • SEPA & Revolut-to-Revolut: FREE

Premium ($9.99/month)

- • $9.99/month

- • $10,000/month free conversions

- • 0.5% fair usage fee after $10k

- • 20% off SWIFT OUR fees

- • Lower transfer fees

- • SEPA & Revolut-to-Revolut: FREE

Metal ($16.99/month)

- • $16.99/month

- • Unlimited free conversions

- • No fair usage fee ever

- • 40% off SWIFT OUR fees

- • Lowest transfer fees

- • SEPA & Revolut-to-Revolut: FREE

- • Travel insurance & perks

Revolut uses interbank exchange rates during market hours (Monday-Friday). For bank transfers, you only pay the transfer fee shown in examples above. Fair usage and weekend fees apply only to in-app currency exchanges, not to bank transfers.

Fee Examples (Standard Plan Only)

✓ $100,000 Transfer (Standard Plan)

$10,000 Transfer (Standard Plan)

✓ These are EXACT fees from real Revolut screenshots (Standard plan, USD→GBP bank transfers). Fair usage and weekend fees do NOT apply to bank transfers - only to in-app currency exchanges.

Using the Revolut Fee Calculator

Our Revolut fees calculator helps you understand the exact costs for different account types and usage scenarios. Enter your transfer amount and see how fees apply based on Standard, Premium, or Metal account benefits. The calculator factors in free allowances and maximum fee caps to give you accurate estimates.

Calculator Features:

- Account type comparison

- Free allowance tracking

- Real exchange rate simulation

- Maximum fee calculations

Ideal For:

- • Frequent international travelers

- • Multi-currency business owners

- • Digital nomads and remote workers

- • Anyone comparing account types

- • Planning large currency exchanges

The calculator is particularly useful for determining whether a Premium or Metal subscription would save you money based on your transfer patterns. If you regularly exceed the free allowances, a paid plan might actually be cheaper than paying per-transaction fees on the Standard account.

Comparing Revolut with Other Options

Revolut offers competitive rates for international transfers and currency exchange, especially for Premium and Metal customers. Their fees are typically lower than traditional banks and comparable to specialized money transfer services like Wise. However, the value depends on your usage patterns and which account type you choose.

Revolut vs Competitors:

Revolut Advantages:

- • Multi-currency account with debit card

- • Real-time exchange rates

- • Modern mobile app experience

- • Additional banking services

- • Instant transfers within Revolut network

Considerations:

- • Monthly fees for premium features

- • Free allowances have limits

- • Weekend exchange rate markups

- • Limited physical branch presence

- • Account restrictions in some regions

For occasional users, Revolut Standard's free allowances might be sufficient. However, heavy users often find Premium or Metal accounts provide better value through higher free limits and additional benefits. Compare carefully with Wise for pure money transfers, as Wise might be cheaper for very large transfers due to their maximum fee caps.

Tips to Save on Revolut Fees

Maximize Free Allowances:

- • Track monthly exchange limits carefully

- • Plan large exchanges within free allowances

- • Use free transfer allowances efficiently

Timing Strategy:

- • Exchange during weekdays for best rates

- • Avoid weekend markups when possible

- • Consider monthly cycles for allowances

Account Upgrade Decision:

Consider upgrading to Premium ($9.99/month) if you:

- • Exchange more than €1,000 per month regularly

- • Make more than 5 international transfers monthly

- • Value the additional insurance and benefits

- • Need higher ATM withdrawal limits abroad

Frequently Asked Questions

How much does Revolut charge for international transfers?

Revolut charges 0.5% for international transfers (maximum $40) for most currencies. Standard accounts get 5 free transfers per month, while Premium and Metal customers get unlimited free transfers. The exact fee depends on your account type and monthly usage.

Is Revolut currency exchange free?

Revolut offers free currency exchange up to certain limits: €1,000/month for Standard, €6,000/month for Premium, and €12,000/month for Metal accounts. Beyond these limits, a 0.5% fee applies. All accounts use real interbank exchange rates.

Does Revolut charge monthly fees?

Revolut Standard is completely free with no monthly fees. Premium costs $9.99/month and Metal costs $16.99/month, offering benefits like higher free exchange limits, better insurance, premium support, and additional financial services.

What currencies does Revolut support?

Revolut supports 30+ currencies including USD, EUR, GBP, JPY, AUD, CAD, CHF, PLN, and many others. You can hold multiple currencies in your account simultaneously and exchange between them at real-time interbank rates during market hours.